LIBOR is an acronym for the London Interbank Offered Rate. Interbank Offered Rates (IBORs) are interest-rate benchmarks used globally across financial markets as reference rates for loans, deposits, derivatives, bonds and other financial instruments.

They are calculated by the Intercontinental Exchange (ICE) and published daily across five currencies (GBP, USD, EUR, CHF and JPY) and seven terms (overnight, one week, and one, two, three, six, and 12 months). Key benchmark interest rates, including the London Interbank Offered Rate (LIBOR), are now under reform by international regulators.

1. What prompted the LIBOR transition?

Since 2014, the International Financial Stability Board (IFSB) has been questioning the reliability of global reference rates (including LIBOR). Concern that these rates posed a risk to the stability of markets was shared by the Bank of England’s Financial Policy Committee. On 27th July 2017, the UK’s Financial Conduct Authority (FCA), together with global regulators and central banks, announced that LIBOR would cease to be published after 31st December 2021.

2. What will replace LIBOR?

All IBORs, including LIBOR, are being replaced with alternative ‘Risk-Free Reference Rates’ (RFRs). Whereas LIBOR is based on a hypothetical figure at which banks believe they can transact, RFRs will be based on transactions that have already taken place. A working group for the Bank of England is administering the change in the UK and the preferred RFR is the ‘Sterling Overnight Index Average’ (SONIA).

3. What are the key industry timelines for the transition?

- 2013: International regulators began focusing on IBOR reform.

- 2014: The International Financial Stability Board raised concerns about the continued use of LIBOR.

- July 2017: The UK’s Financial Conduct Authority (FCA) announced LIBOR would cease to be published after 31st December 2021.

- July 2018: The FCA, together with other regulators and industry groups, instructed the global market to stop using LIBOR-linked facilities and to transition to alternative Risk-Free Reference Rates.

- End Q3 2020: New lending agreements - all banks are required to offer non-LIBOR linked products to customers.

- End 2021: Transition of customers on LIBOR-referencing loan and overdraft products to alternative rates by the end of the year.

However, banks have been urged to stop issuing LIBOR-linked facilities well in advance of the 2021 deadline to ensure an orderly market transition.

4. What is C. Hoare & Co. doing in response to this transition?

As part of C. Hoare & Co.’s preparation for the expected discontinuance of LIBOR at the end of 2021, alongside our replacement of GBP LIBOR-linked services, we have launched lending services structured around alternative reference rates.

The new reference rates selected by the bank are determined, at our sole discretion and after careful consideration, to be a reasonable substitute for LIBOR.

5. How does the transition affect me?

We have already written to all customers holding currency call accounts to inform them of the transition from LIBOR to new reference rates determined by the bank which will be applied in the event of unarranged borrowing. The new rates will apply from 7th January 2021 and new arranged lending will be indexed to alternative reference rates in all major currencies.

We will soon begin the process of transitioning existing LIBOR-linked arranged customer loans and overdraft facilities to an alternative reference rate (e.g. a GBP Bank of England base-rate facility).

We have sought to make this process as seamless as possible for our customers. All relevant facilities have been reviewed individually to identify the appropriate course of action, and relationship managers will be reaching out to all affected customers, from January onwards, to guide them through the transition and the options available to them. We anticipate that this process will be fully complete by July 2021.

It is important to point out that the move away from LIBOR is not an opportunity for banks to increase pricing or costs to borrowers (it has been made very clear that there should be no “winners or losers” from this industry transition). C. Hoare & Co.’s alternative reference rate will be reasonably comparable to LIBOR and will mirror as closely as possible the rate currently paid by our customers.

6. Where can I get further information?

If you would like to know more about IBORs and LIBOR, or if you would like further detail on our approach to the transition and how these changes may affect you, please contact your relationship manager. As ever, they will be very happy to help.

The FCA has also published information on the LIBOR transition which you may find useful (https://www.fca.org.uk/markets/libor).

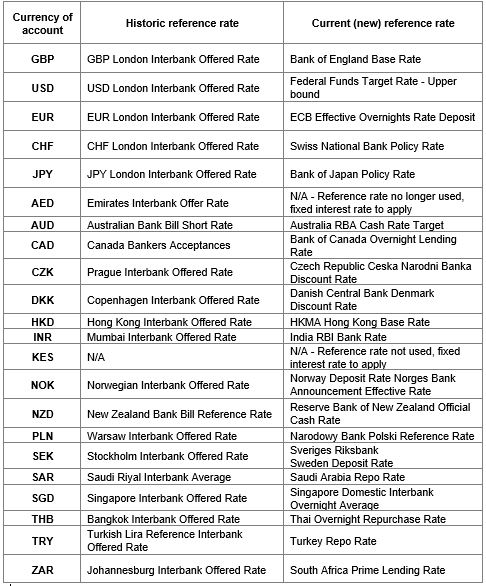

7. Table of old and new reference rates